IJH Wealth Presents Innovative ‘MAIP – Market Adjusted Investment Plan’ Revolutionizing Mutual Fund Investment Strategies

Indore (Madhya Pradesh) [India], August 30: IJH Wealth, a trailblazing name in the financial advisory realm, is excited to unveil a cutting-edge approach to mutual fund investment – the ‘MAIP – Market Adjusted Investment Plan.’ With an unrelenting commitment to delivering superior returns and value to investors, IJH Wealth introduces a groundbreaking strategy that promises to redefine the way investors engage with mutual funds, contributing significantly to financial literacy and success in their investment goals.

Mutual funds have long been heralded as a favorable investment avenue, offering commendable returns over time and garnering widespread popularity among those seeking financial freedom and passive sources of income. While the investment community often acknowledges the market’s inherent risks, a prevailing challenge persists – the strategic approach to entry and exit. IJH Wealth recognizes this void and, in response, has ingeniously formulated the ‘MAIP’ approach, empowering both seasoned investors and budding entrepreneurs alike.

The MAIP strategy, underpinned by the principle of mean reversion, leverages advanced financial modeling techniques to determine the market’s inflated and deflated returns, providing a vital education in finance. Unlike traditional investment philosophies that advocate a ‘Buy Right, Sit Tight’ or ‘Long Only’ portfolio stance, MAIP guides investors in making timely and informed decisions regarding entry and exit points, aligning seamlessly with the millionaire mindset and long-term investment objectives.

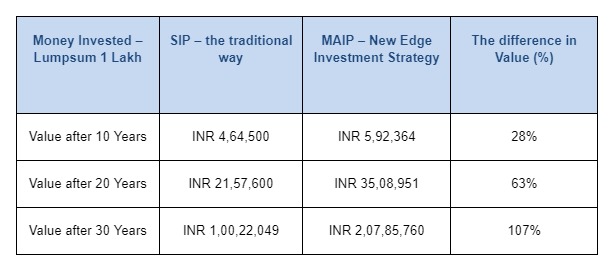

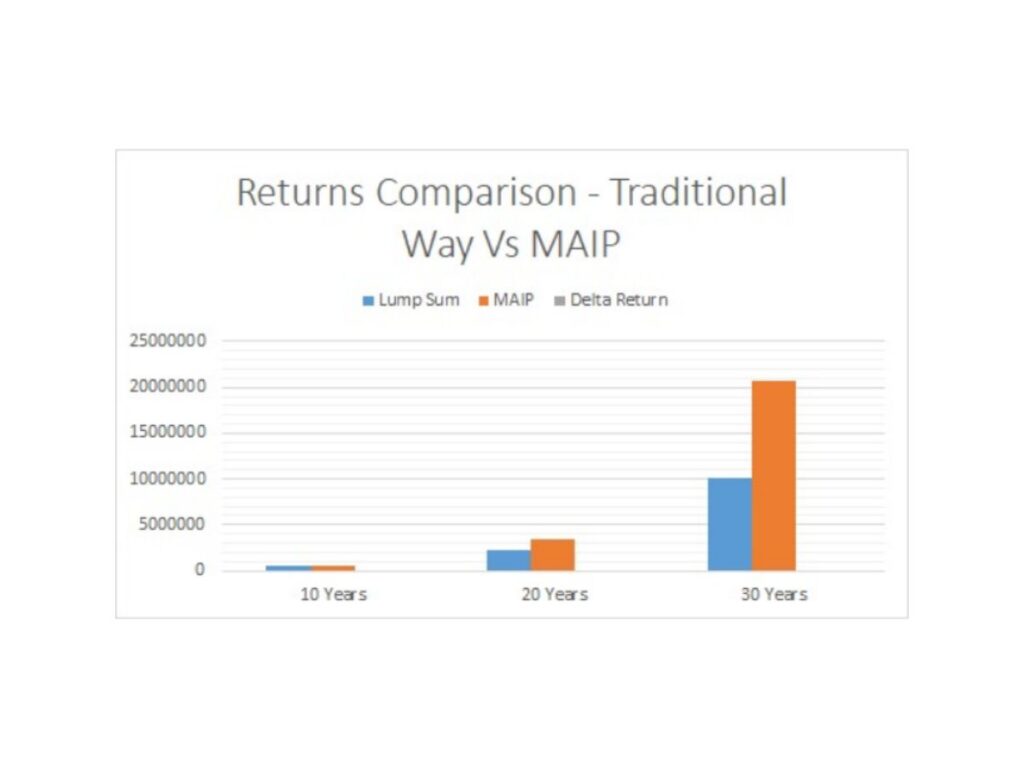

IJH Wealth’s MAIP has undergone rigorous back-testing across various timeframes, producing striking results that highlight its efficacy. A comparative analysis between traditional SIP (Systematic Investment Plan) and MAIP reveals the substantial advantages of this innovative approach, an invaluable lesson in financial education that empowers investors to make sound decisions for their small business ventures and personal financial success.

Note: These computations are made on historic Nav data of Nippon Multicap Growth Fund. The fund has generated a CAGR Return of 16.6% between Jan 2014 to July 2023, whereas the MAIP has generated a CAGR Return of 19.47% – in the same scheme over the same period.

Investors seeking to optimize their mutual fund endeavors and capitalize on unprecedented returns are invited to explore the transformative potential of MAIP. IJH Wealth warmly extends an invitation to integrate this avant-garde investment strategy into their portfolios, laying a robust foundation for long-term investment and entrepreneurial growth.

For personalized consultations and to implement MAIP, contact our dedicated support team at support@ijhacademy.com or visit our official website at www.ijhwealth.com

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.